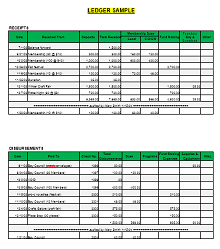

If you fail to maintain monitor of every greenback getting into or exiting your group, your business risks financial instability and potential failure. Your bookkeeping software ought to have all these accounts already within the system. We perceive the distinctive financial challenges faced by marketing firms, promoting businesses, and digital studios, and we’re here to help you achieve clarity, compliance, and development. Track all money obtained, whether or not from shoppers, prospects, or other sources. With plans beginning at $15 a month, FreshBooks is well-suited for freelancers, solopreneurs, and small-business homeowners alike.

- Look for instruments that offer customizable bill templates, recurring invoices, and easy-to-use interfaces.

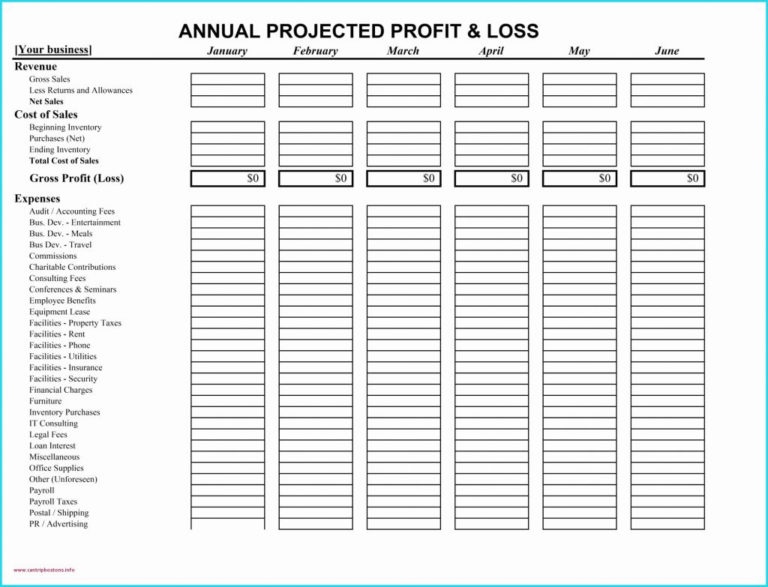

- Budgeting and forecasting are the two massive elements of fine bookkeeping that allow you to extrapolate what your financing needs and opportunities may be sooner or later.

- Bonsai is another freelancer all-in-one app that helps you build automated flows to handle shopper proposals, invoicing, and extra.

- Different options of observe are sales tax handling (if you need to charge it) and a deep accounting part together with your whole chart of accounts.

- The consumer interface has plenty of open space, showing the preview of each doc as you are filling it out.

- I run a small business (sole proprietorship) that has the potential for development and I am questioning what my finest bookkeeping platform would be.

Greatest Self-employed Accounting Software Program For Creating Complete Invoices

I like with the ability to sort by way of my transactions and mark them as business bills, tax-deductible, and so forth. It may be simpler to complete your tax return if the dates match the tax yr (6 April to 5 April). This is as a end result of HM Income and Customs (HMRC) works out tax based on the tax yr. If your accounts don’t match this, you will need to allocate income to 2 totally different accounting intervals. Doing somewhat accounting daily will make your general operations simpler to deal with. Organizing your receipts and invoices as they come in will save you https://www.kelleysbookkeeping.com/ from a huge quantity of labor during tax season.

The software program solely tracks earnings that’s been received and bills that have been paid. If you’re a Linux user, your decisions free of charge accounting software program are more restricted. GnuCash is a good option that’s appropriate with Linux, as nicely as Windows, BSD, Solaris and Mac. It consists of options, corresponding to checking account tracking, expense tracking, monetary calculations and reports.

Tips On How To Succeed As A Self-employed Bookkeeper

However as your business grows utilizing a spreadsheet to handle a appreciable amount of knowledge things can get tricky and time-consuming. Navigating tax obligations is a major aspect of bookkeeping for self-employed professionals. Understanding tax obligations helps avoid penalties and ensures compliance with rules. This entails being aware of deadlines, submitting requirements, and potential deductions that can reduce taxable earnings. Tax software program like TurboTax or TaxSlayer can help in organizing and filing taxes effectively. Accounting software program like QuickBooks or Xero can streamline the setup and management of a chart of accounts.

Sustaining Detailed Expense Information

As a freelancer, I know that you just’re not self-employed for the love of admin work. That Is why you need freelance accounting software that can take care of all the main points for you, so you can focus on your precise work. Since accountants know the deductions and credits available for self-employed people, you can take advantage of such potential financial savings. As a self-employed individual, understanding your tax obligations and staying compliant with tax rules is essential. Failing to correctly manage your taxes may end up in penalties, curiosity charges, and even authorized penalties.

These instruments usually include pre-configured templates tailor-made to numerous industries, which could be customized to suit the unique needs of a self-employed professional. By leveraging such software, individuals can automate transaction categorization, lowering bookkeeping for self-employed guide entry errors and saving time. With Out these information, you won’t know where your corporation is coming from or going. The good news is that the majority accounting software for self-employed professionals can automate P&L monitoring.

Enterprise Tax

To assist you to find one of the best free accounting software program in your needs, we’ve compiled a list of our high picks. Forbes Advisor chosen these solutions based mostly on pricing, features, help, status and extra. As a self-employed individual, managing your finances successfully is crucial to the success of your business. Accounting and bookkeeping are important duties that allow you to hold monitor of your revenue, expenses, and taxes.